Understanding the Shift in Venture Ecosystem

The year 2022 marked a transition in the tech venture ecosystem, witnessing a decline in investment activity following a period of significant growth in 2020-21. Several factors contributed to this shift, prompting business owners to adapt to evolving market dynamics.

Factors Influencing the Venture Landscape

- Cyclicality of Venture Markets: Historically, India has experienced cycles of heightened venture activity, driven by successful ventures in sectors like technology, e-commerce, and fintech.

- Internet Penetration: Increased internet penetration, facilitated by affordable data plans and smartphones, fueled the growth of digital businesses across various sectors.

- Digitization Amidst COVID-19: The pandemic accelerated digitization efforts, leading to a surge in demand for digital solutions across industries.

- Availability of Capital: Favorable monetary policies, characterized by low interest rates and ample liquidity, encouraged investment activity in the venture space.

Shifting Dynamics in 2023

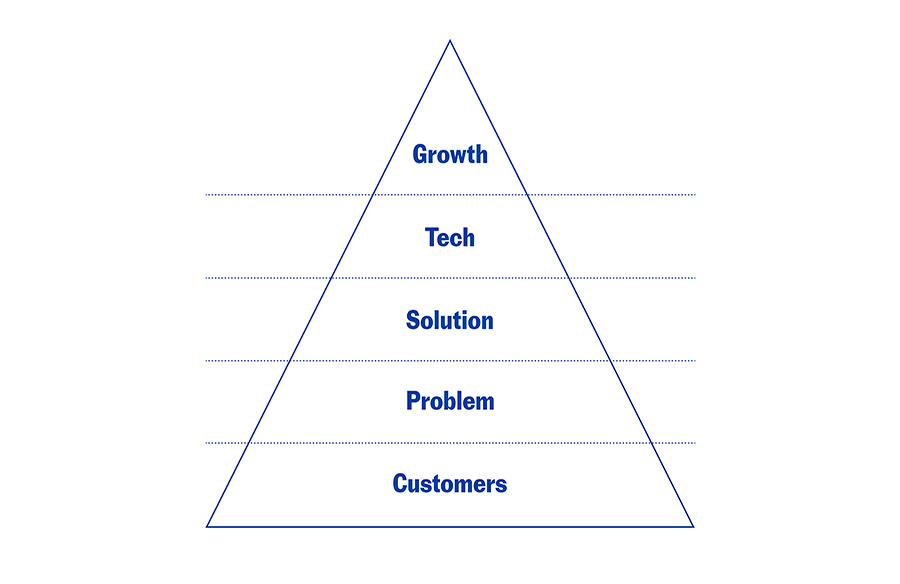

As 2022 progressed, the venture landscape witnessed significant changes, including rising interest rates, stabilized internet penetration, and a growing emphasis on profitability over growth. While digitization remained a driving force, other factors began to impact investment sentiment.

Implications for Startup Entrepreneurs

- Capital Prudence: With funding expected to remain tight in 2023, entrepreneurs must adopt a conservative approach to capital expenditure and prioritize financial sustainability.

- Extended Runway: Entrepreneurs should aim to secure funding that provides a runway of at least two years, allowing for flexibility and cushioning against market uncertainties.

Opportunities Amidst Challenges

- Selective Investment: Despite the cautious approach of investors, funds continue to deploy capital in promising ventures. Quality businesses with robust fundamentals are likely to attract disproportionate interest from investors.

- Market Consolidation: The downturn may result in the consolidation of the market, creating opportunities for established players to dominate their respective sectors.

- Talent Availability: Economic uncertainties may lead to layoffs, creating a pool of skilled talent available for recruitment. Companies can capitalize on this to strengthen their teams.

Embracing Digitization and Innovation

Despite funding challenges, opportunities abound in sectors such as finance, healthcare, and logistics, driven by ongoing digitization efforts. Emerging technologies like AI and blockchain present new avenues for innovation and growth.

Seizing Opportunities in a Challenging Environment

While market downturns pose challenges, they also present opportunities for agile and resilient businesses. Entrepreneurs equipped with the right attributes and a focus on addressing real market needs are well-positioned to thrive amidst uncertainty.

In conclusion, navigating the funding landscape in 2023 requires a strategic approach, resilience, and a keen understanding of market dynamics. By embracing innovation, prudent financial management, and a focus on quality, businesses can navigate the challenges and emerge stronger in the long run.