Are you ready to unlock thousands in savings through strategic year-end tax planning? Don’t miss out on our exclusive webinar, “Top 10 Year-End Tax Strategies To Save Yourself Thousands,” featuring renowned experts Mark J. Kohler, CPA, and Mat Sorensen.

What You’ll Learn

In this enlightening webinar, you’ll gain invaluable insights into:

- Foolproof Write-Off Strategies: Discover how to leverage write-off strategies for purchasing new automobiles or equipment before year-end.

- Maximizing Retirement Contributions: Learn how to maximize contributions to IRAs and 401(k)s to reap the highest tax benefits.

- Common Deductions: Explore common deductions such as home office expenses and travel costs to achieve significant savings.

- Tax Status Transition: Understand when it’s advantageous to transition from LLC (sole prop) to S-Corporation tax status before year-end.

- Closing Out Entities: Learn how to close out old entities by year-end to avoid new FinCEN registration in 2024.

- Entity Setup Timing: Gain insights into determining the optimal timing for setting up your LLC or entity—before year-end or on Jan 1, 2024.

Don’t Miss This Opportunity

This webinar presents a golden opportunity to master year-end tax planning and unlock substantial savings for your small business. Secure your spot now and let our experts guide you toward financial success.

About the Speakers

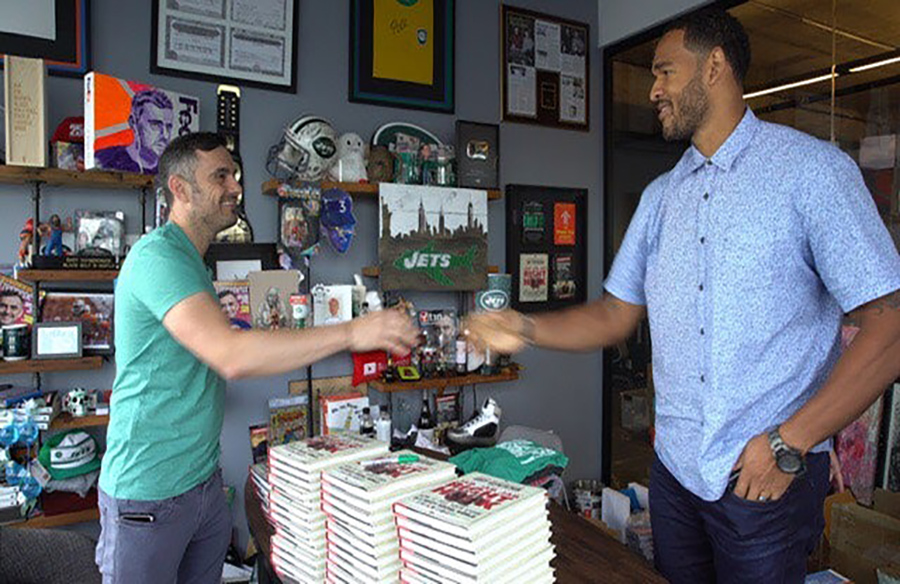

Mark J. Kohler, CPA: Mark is an esteemed author, attorney, and co-host of the Podcast “Main Street Business.” He serves as a senior partner at both the law firm KKOS Lawyers and the accounting firm K&E CPAs. Mark is the author of “The Tax and Legal Playbook, 2nd Edition,” and “The Business Owner’s Guide to Financial Freedom.”

Mat Sorensen: Mat is a distinguished attorney, CEO, author, and podcast host. He serves as the CEO of Directed IRA & Directed Trust Company, a leader in the self-directed IRA and 401(k) industry. Mat is also a partner in the business and tax law firm of KKOS Lawyers and the author of “The Self-Directed IRA Handbook.”